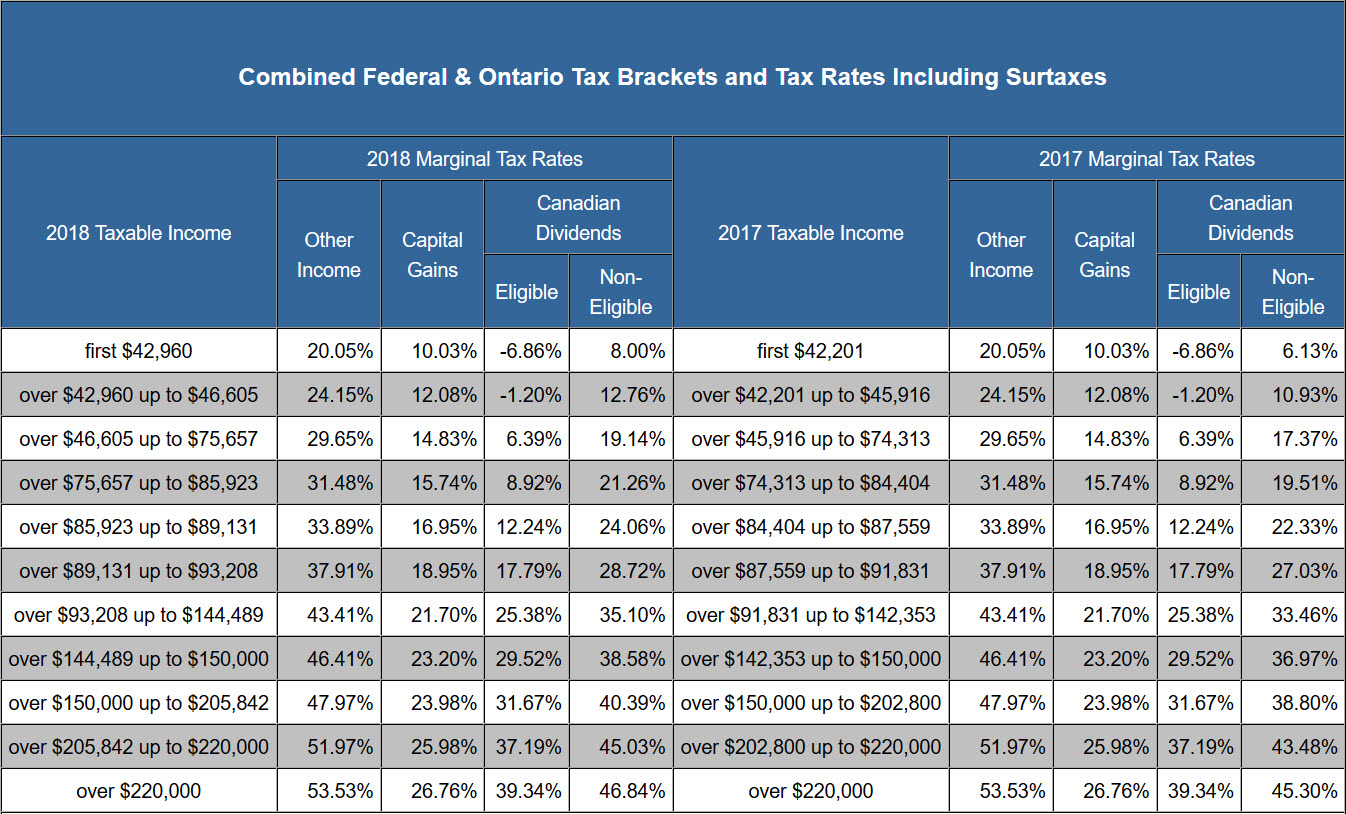

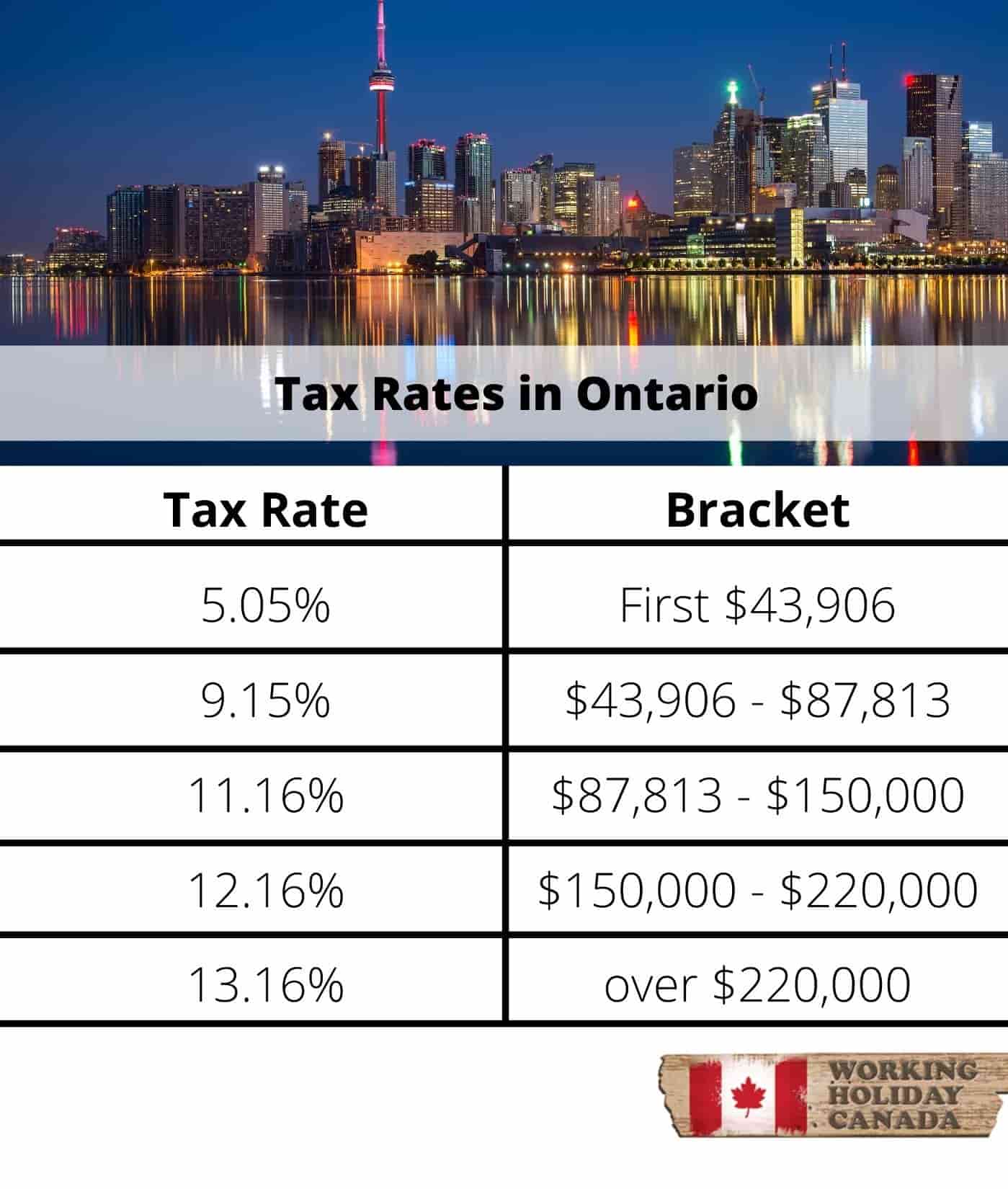

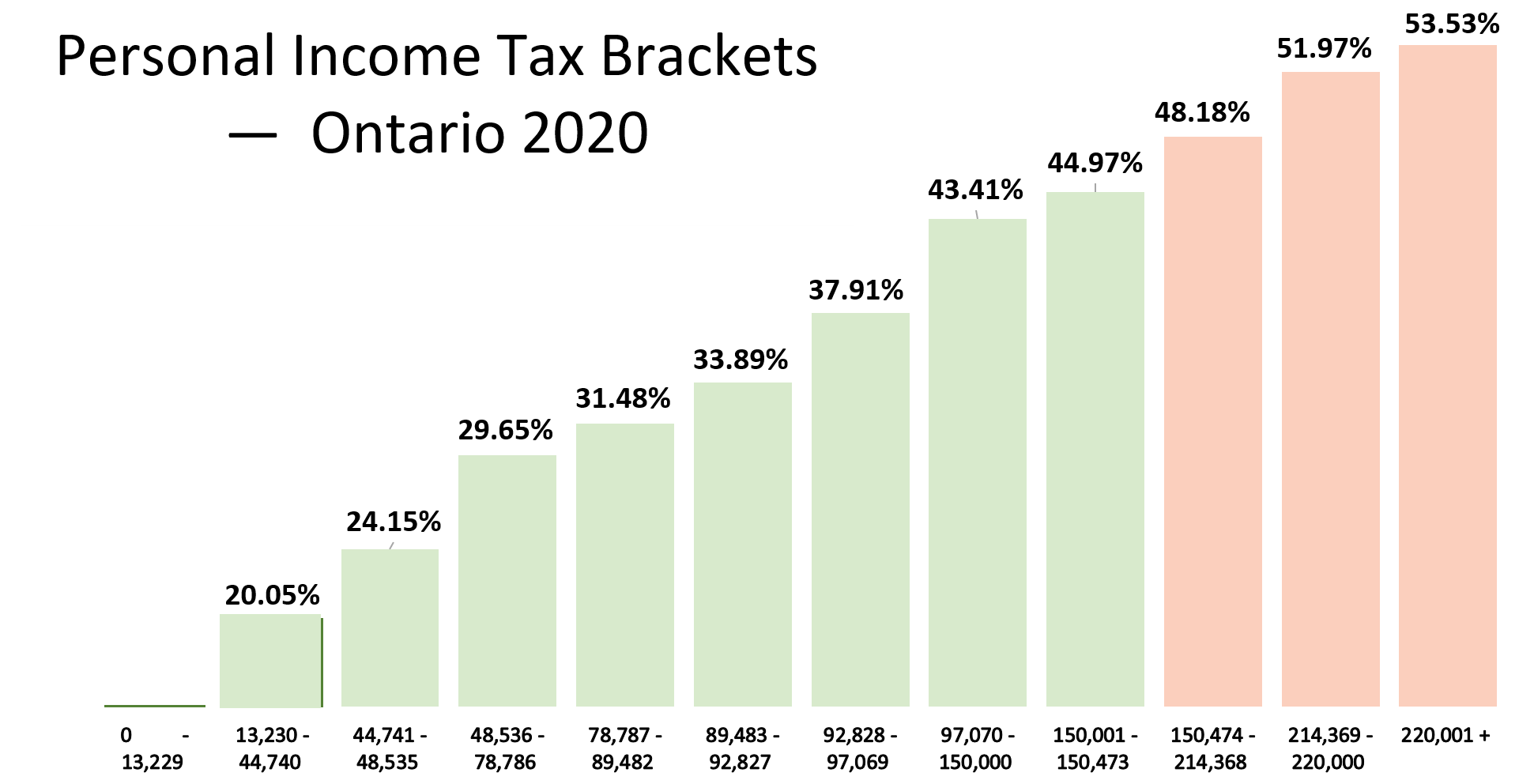

Ontario Income Tax Brackets 2025. Use our income tax calculator to find out what your take home pay will be in ontario for the tax year. The tax rates in ontario range from 5.05% to 13.16% of income and the combined federal and provincial tax rate is between 20.05% and 53.53%.

The tax is calculated separately from federal income tax. Combined tax rate (2025) basic personal amount;

Canada Tax Rates 2025 Meara Paloma, Federal and provincial territorial income tax rates and brackets for 2025 current as of december 31, 2025

The basics of tax in Canada », Since ontario is the largest province in canada with the highest population, let’s start by taking a look at the different tax brackets in ontario and what they mean.

Marginal Tax Rates How To Calculate Ontario Tax Kalfa Law Firm, Your taxable income is your income after various deductions, credits, and exemptions have been applied.

Tax Brackets 2025 Canada Ontario Myrle Tootsie, Personal income tax is collected annually from ontario residents and those who earned income in the province.

Tax Brackets 2025 India Imran Gemma, The tax rates in ontario for 2025 range from 20.05% to 41.66%, depending on your income.

Irs 2025 Tax Changes Wesley Zeeshan, The tax is calculated separately from federal income tax.

Tax Brackets Canada 2025 Blog Avalon Accounting, The tax rates in ontario range from 5.05% to 13.16% of income and the combined federal and provincial tax rate is between 20.05% and 53.53%.